Achieving Financial Success in College: Practical Preparation Tips for Pupils

As tuition prices proceed to rise and living expenses include up, it is critical for pupils to establish useful planning approaches to accomplish financial success throughout their university years. From setting economic goals to taking care of pupil car loans, there are numerous actions that trainees can take to ensure they are on the appropriate track in the direction of a stable economic future.

Setting Financial Goals

When establishing economic goals, it is vital to be reasonable and particular. Setting unrealistic objectives can lead to irritation and prevent you from continuing to work in the direction of monetary success.

Additionally, it is very important to prioritize your financial objectives. Identify what is most essential to you and concentrate on those objectives. Whether it is paying off pupil finances, saving for future expenditures, or developing an emergency fund, recognizing your concerns will assist you allocate your sources efficiently.

Developing a Budget Plan

When developing a budget, beginning by establishing your incomes. This can consist of cash from a part-time work, scholarships, or financial assistance. Next, listing all your expenses, such as tuition fees, textbooks, rent, utilities, transport, and meals. When approximating your costs., it is crucial to be reasonable and comprehensive.

Once you have actually determined your income and expenditures, you can allot your funds appropriately. Consider reserving a portion of your revenue for cost savings and emergencies. This will certainly assist you construct a safeguard for future goals and unanticipated costs.

Testimonial your budget plan regularly and make changes as needed. This will certainly ensure that your budget plan remains sensible and effective. Tracking your costs and contrasting them to your budget will certainly aid you determine locations where you can reduce or make enhancements.

Developing a budget is a crucial device for financial success in university. It permits you to take control of your finances, make notified choices, and work towards your monetary objectives.

Taking Full Advantage Of Scholarships and Grants

Making best use of gives and scholarships can significantly alleviate the financial worry of university expenses. Scholarships and gives are kinds of financial assistance that do not need to be settled, making them a perfect method for trainees to money their education and learning. Nonetheless, with the rising cost of tuition and charges, it is vital for pupils to optimize their opportunities for grants and scholarships.

One method to maximize scholarships and grants is to begin the search early. Many organizations and institutions offer scholarships and grants to pupils, yet the application target dates can be months beforehand. By beginning early, pupils can look into and use for as many opportunities as feasible.

In addition, pupils must completely read the eligibility needs for each and every scholarship and give. Some may have particular criteria, such as scholastic success, neighborhood involvement, or specific majors. By understanding the needs, trainees can tailor their applications to highlight their strengths and raise their possibilities of receiving financing.

Moreover, students must consider using for both local and nationwide gives and scholarships. By expanding their applications, trainees can maximize their possibilities of securing monetary help.

Handling Pupil Car Loans

One see this crucial element of browsing the financial duties of college is efficiently taking care of student finances. With the rising expense of tuition and living expenditures, many trainees count on lendings to fund their education and learning. Mishandling these loans can lead to long-lasting monetary problems. To prevent this, pupils should take a number of steps to successfully handle their pupil lendings.

First and primary, it is very important to comprehend the conditions of the finance. This includes knowing the rate of interest, settlement duration, and any type of prospective charges or charges. By recognizing these details, students can intend their funds as necessary and stay clear of any type of surprises in the future.

Creating a budget is an additional crucial action in handling trainee car loans. By tracking income and expenditures, pupils can make sure that they assign enough funds in the direction of lending repayment. This additionally assists in determining locations where costs can be decreased, enabling even more money to be routed in the direction of car loan repayment.

In addition, students need to check out options for financing mercy or repayment help programs. These programs can offer alleviation for debtors that are having a hard time to repay their financings. It is necessary to research and comprehend the eligibility requirements and requirements of these programs to take complete benefit of them.

Finally, it is crucial to make timely loan repayments. Missing out on or delaying settlements can lead to extra costs, charges, and adverse impact on credit history. Establishing automated payments or tips can aid guarantee that repayments are made on time.

Saving and Investing Approaches

Navigating the monetary obligations of university, including efficiently handling pupil lendings, sets the structure for trainees to carry out saving and investing strategies for lasting economic success.

Saving and investing methods are crucial for university student to protect their monetary future. While it might seem daunting to start saving and investing while still in college, it is never as well very early to begin. By carrying out these methods beforehand, students can make use of the power of compound interest and build a strong economic structure.

Among the very first steps in spending and saving is creating a budget. This allows students to track their revenue and expenditures, recognize locations where they can reduce back, and designate funds towards savings and investments. It is essential to establish certain monetary goals and create a strategy to accomplish them.

One more method is to develop an emergency situation fund. This fund works as a safety and security web for unanticipated expenditures or emergency situations, such as clinical expenses or cars and truck repair services. By having an emergency situation fund, trainees can prevent going into debt and maintain their financial stability.

Verdict

To conclude, by establishing economic goals, producing a spending plan, optimizing scholarships and grants, taking care of pupil loans, and implementing saving and investing methods, university students can accomplish economic success throughout their academic years - Save for College. Embracing these functional preparation tips will assist trainees create liable financial practices and make sure an extra secure future

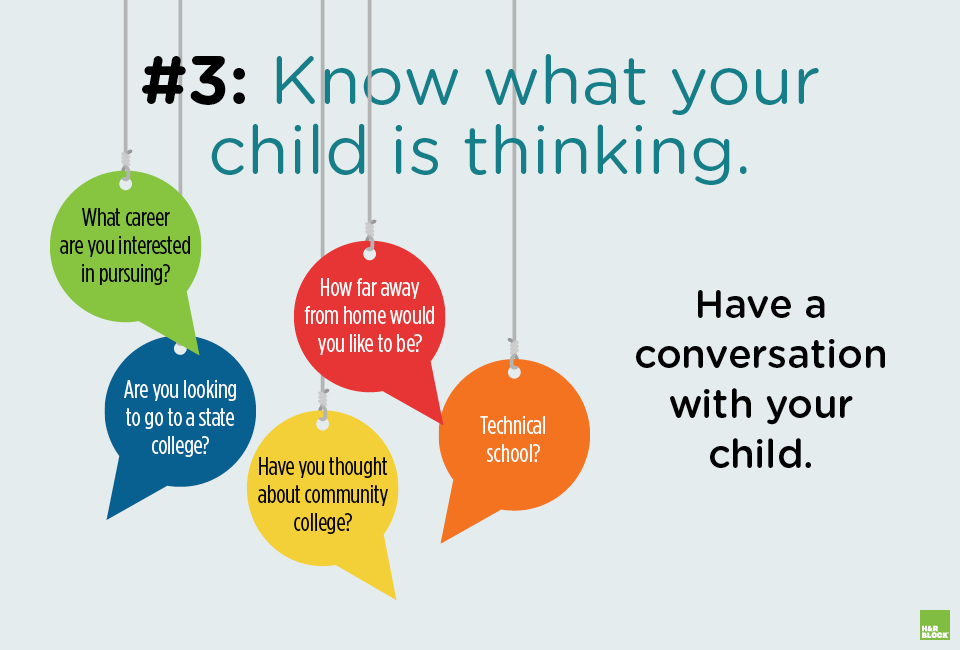

As tuition costs continue to increase and living costs include up, it is critical for students to develop practical planning techniques to accomplish monetary success during their college years. From setting monetary goals to handling trainee finances, there are countless actions that pupils can take to guarantee they are on the appropriate track in the direction of a secure monetary future.One vital facet of browsing the he said monetary obligations of college is efficiently managing student lendings. To avoid this, pupils need to take numerous actions to efficiently manage their student loans.

Conserving and spending methods are vital for college students to safeguard their monetary future.